36+ Talent Income Tax Calculator

See how your withholding affects your refund take-home pay or tax due. The more someone makes the more their income will be taxed as a percentage.

Income Tax Calculator Find Out Your Take Home Pay Mse

Web How much are your employees wages after taxes.

. Web SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. Web Get started with the TaxTalent salary calculator today with your FREE TaxTalent membership. And is based on the tax brackets of 2022 and 2023.

0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 What are Tax Brackets. Web Use our paycheck tax calculator. This calculator also assumes 52 working weeks or 260 weekdays per year in its calculations.

Web Estimate how much youll owe in federal income taxes for tax year 2023 using your income deductions and credits all in just a few steps with our tax calculator. Your household income location filing status and number of personal exemptions. 220 Tax as a percentage of your taxable income.

All other pay frequency inputs are assumed to be holidays and vacation days adjusted values. Help Paste this link in email text or social media. Use this tool to estimate the federal income tax you want your employer to withhold from your paycheck.

What Is My Tax Rate. 3036 hourly is how much per year. The federal income tax is a progressive tax meaning it increases in accordance with the taxable amount.

For more information see our salary paycheck calculator guide. The 2023 tax values can be used for 1040-ES estimation planning ahead or comparison. Web Estimate your tax refund or how much you may owe the IRS with TaxCaster tax calculator.

Web The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. This marginal tax rate means that your immediate additional income will be taxed at this rate. If youre an employee generally your employer must withhold certain taxes such as federal tax withholdings social security and Medicare taxes from your.

And if your income is 1 million your tax obligation is still 45 or 45000. Use the Neuvoo Talent salary calculator to convert any salary on an Hourly Daily Weekly Bi-weekly Monthly or Yearly basis. 75066 How could this calculator be better.

These include Colorado Illinois Indiana Kentucky Massachusetts Michigan New Hampshire North Carolina Pennsylvania and Utah. But whereas W-2 employees split the combined FICA tax rate of 153 with their employers 1099 workers are responsible for the entire amount. What is the average salary in Australia.

Web For each payroll federal income tax is calculated based on the answers provided on the W-4 and year to date income which is then referenced to the tax tables in IRS Publication 15-T. Web If your taxable income is 100000 your state income tax is 4500. It is mainly intended for residents of the US.

Web Your average tax rate is 217 and your marginal tax rate is 360. Web Tax Withholding Estimator. Only ten states apply a flat tax rate on incomes.

Web Income Tax Calculator Tax Year. Get instant salary conversions. Simply enter your taxable income filing status and the state you reside in to.

Feel confident with our free tax calculator thats up to date on the latest tax laws. Only the highest earners are subject to this percentage. This is tax withholding.

In 2023 the federal income tax rate tops out at 37. Web Federal Income Tax. Be eligible for enforcement relief of rep and warrant on the income calculation.

For 2024 rates are 0 10 12 22 24 32 35 or 37. Share this Answer Link. Web Our income tax calculator calculates your federal state and local taxes based on several key inputs.

This powerful tool does all the gross-to-net calculations to estimate take-home pay in all 50 states. Web Day Hour Withholding Salary 60000 Income Tax - 9967 Medicare - 1200 Total tax - 11167 Net pay 48833 Marginal tax rate 345 Average tax rate 186 814 Net pay 186 Total tax People also ask 60000 yearly is how much per hour. This salary calculator assumes the hourly and daily salary inputs to be unadjusted values.

Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. Web Maximize the borrowers income by utilizing allowable add-backs not found in 4506-C tax return transcript data which may result in better pricinglower DTI due to higher income being calculated. 1169 Net Income after Tax is paid.

You are able to use our United States Salary Tax Calculator in order to determine how much of your annual salary goes into your bank account and how much of it goes towards payments such as. Filing status Annual taxable income Your 2023 marginal tax rate. Web VDOM DHTML tml Federal Income Tax Calculator 2022-2023 and W-2 employees must pay FICA taxes for Social Security and Medicare.

Web Use our Tax Calculator Tax Bracket Calculator Enter your tax year filing status and taxable income to calculate your estimated tax rate. For more information on a comprehensive salary benchmark for any of your top 20 tax positions we encourage you to explore our Benchmark Compensation Studies or call one of our tax salary specialists at 843-216-7444. Web United States Salary Tax Calculator for 202324.

Enter your info to see your take home pay. Web You can use our Income Tax Calculator to estimate how much youll owe or whether youll qualify for a refund. Web Browse by locations.

This marginal tax rate means that your immediate additional income will be taxed at this rate. Determine the qualifying monthly income before submitting to DU.

Calameo Dan S Papers September 3 2021 Issue 2

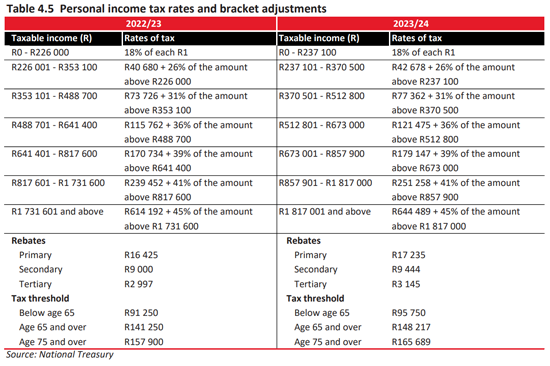

Budget 2023 Your Tax Tables And Tax Calculator Wessels Van Zyl Inc

Salary After Tax Calculator Taxscouts

14 Salary Certificate Templates For Employer Pdf Doc

Support Resources Hub Children And Young People S Strategic Partnership Cypsp

36 000 After Tax 2023 2024 Income Tax Uk

The Big Book Of Decorator Balloons By Amscan International Issuu

What S The Most Underpowered Playable Character In 5e D D Quora

Calameo Dan S Papers September 3 2021 Issue 2

Norwood March 2022

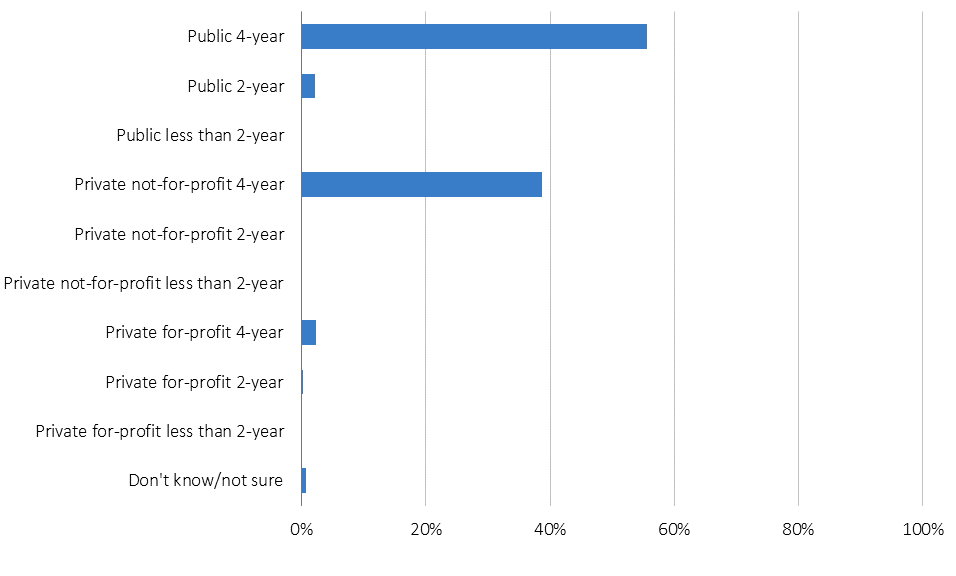

A Census Ii All Archivists Survey Report Ithaka S R

Income Tax Calculator And Salary Calculator For 2023 24 2022 23 And 2021 22 Which

Income Tax Calculator Fy 2022 23 Ay 2023 24 Fully Automatic Auto Increment And Both New And Old Tax Regime And Undertaking Generator Updated On 9 November 2022 Delhi School Teachers Forum

Salary After Tax Calculator By Salarybot

Talent Calculator Tax

Income Tax Calculator Fy 2022 23 Ay 2023 24 Fully Automatic Auto Increment And Both New And Old Tax Regime And Undertaking Generator Updated On 9 November 2022 Delhi School Teachers Forum

Jpmorganpresentation1152