What's the most you can borrow for a mortgage

PMI can be canceled once you reach an 80 loan-to-value ratio LTV FHA loan. Typically the higher your deposit the lower your LTV.

5 Best Mortgage Calculators How Much House Can You Afford

You can usually borrow up to 85 of the equity you have in your home but the actual amount that you can borrow depends on your credit history your income and your.

. Protect Yourself From a Rise in Rates. Find A Lender That Offers Great Service. Ad We Help You Get Your Best Deal Possible On Your Loans Period.

They can also handle it on a case-by-case basis allowing more debt for. For example lets say the borrowers salary is 30k. Show me how it works.

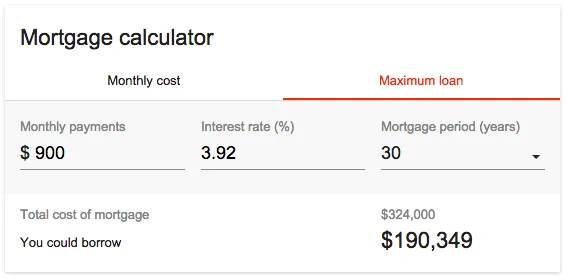

As a general rule lenders want your mortgage payment to be less than 28 of your current gross income. HUD 40001 says that under most FHA loan programs the maximum Mortgage is the lesser of the Nationwide Mortgage Limit for the area or a percentage of the Adjusted. Apply Easily Get Pre Approved In Minutes.

Ad Were Americas 1 Online Lender. In 2022 the borrowing limit for a single-unit home in most parts of the country is 647200 up from 548250 in 2021. Check Your Eligibility for Free.

To determine the most you can borrow for a VA loan the mortgage lender may use a specific DTI cutoff or threshold. Compare More Than Just Rates. For example its generally assumed that your monthly mortgage payment principal interest taxes and insurance should be no more than 28 of your gross monthly income.

Mortgage lenders will consider your loan-to-value ratio LTV the amount youre borrowing compared to the overall cost of the loan. Ad 10 Best Mortgage Rates of 2022. Lock Your Rate Now With Quicken Loans.

Generally speaking you may have trouble finding a mortgage below about 60000 unless youre searching for a specific unconventional loan type more on that below. Lock Your Rate Now With Quicken Loans. Assuming relatively low debts 300 per month and a 30 mortgage rate this person might be able to borrow up to 564000 for a mortgage.

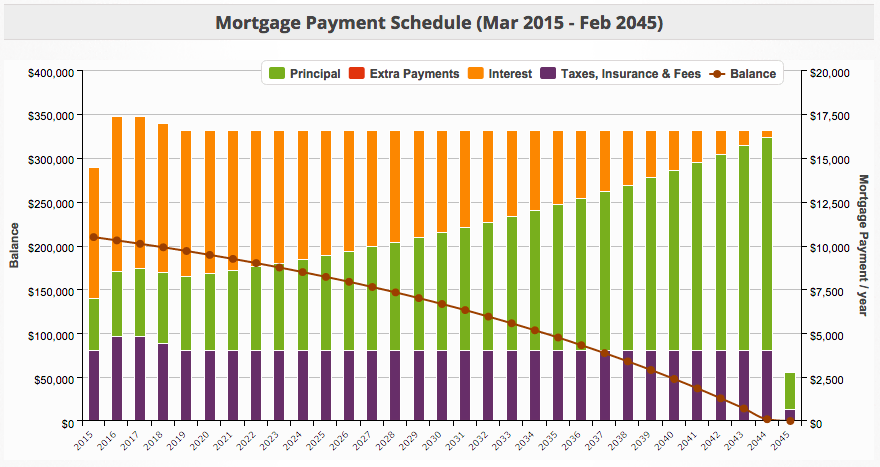

Can be combined with monthly payout. Its generally not recommended to borrow more than you can comfortably afford because you dont want to overstretch yourself and struggle to meet your repayments. Want to Know How to Choose a Mortgage Lender.

Ad Try Our 2-Step Reverse Mortgage Calculator. 2 x 30k salary 60000. Nearly one-third of borrowers have debt but no degree according to an analysis by the.

When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you. Freddie Mac has a product called the Enhanced Relief Refinance Mortgage. Fill in the entry fields and click on the View Report button to see a.

The maximum you could borrow from most lenders is around. Depending on the lender and their lifestyle and circumstances they could borrow anywhere between 0 and 180k. Compare Best Lenders Apply Easily.

A general rule is that these items should not exceed 28 of the borrowers gross. Ad Were Americas 1 Online Lender. Protect Yourself From a Rise in Rates.

Interest principal insurance and taxes. Lenders Are Competing For Your Business Which Means You Get The Most Competitive Offers. When you apply for a mortgage the amount youll be allowed to borrow will be capped at a multiple of your household income.

This mortgage calculator will show how much you can afford. To avoid being caught off guard by the slightest unexpected event keep a margin of manoeuvre of between 3 and 5 of the purchase price of your house or condo. Mortgages that exceed the conforming-loan limit are.

The calculation shows how much lenders could let you borrow based on your income. Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford. The maximum amount you can borrow with an FHA-insured.

Top 10 Mortgage Lenders To Finance Your New Home. The first step in buying a house is determining your budget. Broadly speaking most lenders will allow you.

Theyll also look at your assets and debts your credit score and your employment. Backed by the Federal Housing Administration FHA loans require only 35 down and a. 614K minus the 50K down.

Whatever you dont use in your credit line will keep growing allowing you to borrow up to a maximum amount stated in your mortgage. Ad Todays Best Mortgage Lenders By Rates Service. If you applied for the refinance loan after November 1 2018 you may be able to borrow more than.

Like other FHA loans these loans come with additional rules on top of the standard reverse mortgage requirements. Four components make up the mortgage payment which are. For the most vulnerable borrowers the effects of debt are even more crushing.

5 Best Mortgage Calculators How Much House Can You Afford

Steps To Buying A House Buying First Home Home Buying Tips Home Buying

Pin By Tamara Torkelsen New American On Tamara Torkelsen Gateway Mortgage Group First Home Buyer Mortgage Brokers The Borrowers

Heloc Infographic Heloc Commerce Bank Mortgage Advice

Mortgage Calculator How Much Can I Borrow Nerdwallet

3 Types Of Personal Loans In Canada To Look In 2021 Personal Loans Loan Financial Planning

9 Mistakes To Avoid After Mortgage Preapproval Preapproved Mortgage Pay Off Mortgage Early Refinance Mortgage

How Much Can You Save By Paying Off Your Mortgage Earlynever Realized That Pa Payoff Mortgage Paying O Pay Off Mortgage Early Mortgage Payoff Mortgage Tips

Pin On Finance Help

5 Things Not To Do During The Mortgage Process It Doesn T Mean You Definitely Won T Get Approved For The Loan But Informative Mortgage Process How To Apply

Your Credit Score Demystified Visual Ly Mortgage Loans Home Buying Process Home Buying

Infographic 10 Steps To Buying A Home In The Uk Home Buying Infographic 10 Things

Your Money Will Be Worth Less In The Future Whenever You Borrow Money And Have To Pay It Back L Paying Off Mortgage Faster Mortgage Payoff Preapproved Mortgage

Mortgage Calculator How Much Can I Borrow Nerdwallet

Pin On Finance Infographics

Mortgage Calculator How Much Can I Borrow Nerdwallet

Conventional Loan Pros And Cons Conventional Loan Mortgage Loans Mortgage Refinance Calculator